Many people thinks that a lot of money comes first, and financial freedom comes after. But that is not the way it works, if it were, we would have lots of happy histories of lottery winners and not a lot of tragedies.

Financial freedom comes first, the lots of money comes after. Only when you have financial freedom you are free to explore and develop your talents, and if you develop skills in something that you are passionate about, you don’t even have to go after the money, the money will come to you.

But you won’t care, because you have reached a point where you don’t need that money to survive anymore. That will keep you away from bad offers, and from the temptation to spend it all at once and go back to square one.

Ok then, what is financial freedom?

Financial Freedom, also known as Financial Independence, means that you no longer need to work to survive. You no longer need to work to put food in your mouth and a roof over your head, or worry about the mouths and the heads of your family.

Financial freedom means that you are free to do what you want to do, regardless of whether that will put money in your pocket or not. That is freedom. It is freedom to be who you are not having to obey the commands of others or engage in activities that you dislike but “have to do, or else…”

Your age has nothing to do with this, it is all in the numbers. If you are less than 30 years old, you live with USD$100 a month, and you have different sources of income that do not require your participation; and this sources generate USD$101, then you have financial freedom. However, you may be spending $1,000,000 a month while getting $950,000, which means that you have to work to get those extra $50,000 a month. This means that you are not financially independent, you have to work and you are a few salaries away from complete bankrupcy.

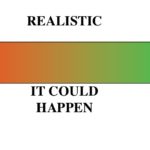

If you are like me before (and not that long ago to be honest), this sounds like just a dream that is unreachable. But it is not, it is not unreachable but it is hard to achieve.

Why is it so difficult to achieve?

Because we have some weaknesses as human beings, and there is an entire industry dedicated to exploit our weaknesses.

Desire, ego… there are many things that, from a very early age, have been implanted on us. Via advertisements, via the society. They link our value as persons to what we own, and are given a set of things that we have to own or do in order to be worth anything.

We are given idols who own a lot. And so, many want to be with them, while others want to be like them so the gender they feel attracted to will want to be with them. The “cool kids” at school are the ones with the fancy toys; and through advertising we got implanted that desire to own those things. So we hang out around them, even though some of those “cool kids” are spoiled assholes who see us as less than them.

We are given idols who own a lot. And so, many want to be with them, while others want to be like them so the gender they feel attracted to will want to be with them. The “cool kids” at school are the ones with the fancy toys; and through advertising we got implanted that desire to own those things. So we hang out around them, even though some of those “cool kids” are spoiled assholes who see us as less than them.

And then we grow, we get in debt to own things that we don’t really need, then spend our adult lives working to keep the debt from growing out of control through interest; so we can get more debt and get to live. And don’t get me started in getting debt to study a career that we don’t get to use.

It works for some people, but that is not the point, some people also win the lottery, but chances are the lottery will not make a difference in your life…

So, how to achieve financial freedom?

First of all, you need to know how much are you spending monthly and in what.

Use pen and paper, or an Excel sheet. You don’t have Excel? LibreOffice is free as in speech and as in beer and allows you to have the same functionality of an Excel sheet. Or there is Google Drive with the same and in your browser. Or use a financial program if you are going serious about the control of your finances, I utilize KMyMoney, also free as in speech and free as in beer.

With that at hand, then there are three usual paths:

- Keep your same monthly expenses, increase your income, save the extra income.

- Keep your same income, reduce your monthly expenses, save the remaining money.

- Do both, reduce your expenses and increase your income, save the extra money.

But there is one more way:

Keep your monthly expenses and your income, meanwhile build and grow a passive income.

What is passive income?

Passive income is money that you can get while you are sleeping, eating, playing or in the toilet. In other words, it’s money that comes to you whether you do something or not.

There are many sources of passive income:

- A retirement pension at the end of your career, if you are lucky. These days young people are facing a world where this is not an option anymore.

- Honoraries for a work of art you made. It could be a book, a song, things like that. A book, no matter the size, you only have to write it once.

- Now thanks to the Internet you can either sell something online, or have a blog or a web site with ads. You write the articles once, you take the pictures once; then you put them online, and don’t think about it, something will come to you.

- Building a network in a company with multilevel marketing. Be careful of scams and those systems known as “pyramid schemes”, they just take money from the last who join to give it to the first who join, then it collapses.

My advice, look at Amway, around since 1959 and they do make high quality products. It has been investigated as a pyramid scheme and it was found not to be one of those. These days it is one of the largest companies. If you want to build a network outside of the Internet, I advice this one, and if you contact me I can put you under some good sponsors who will coach you and give you good advice to go this way.

And Online… here is where the PTC networks find its place.

How can I use PTC networks to achieve financial freedom?

That’s why I am here. So to not make this entry even longer, I’ll resume the few steps, then I can expand later on, in further articles.

While the PTC Networks can give you an extra source of income, for example ClixSense with surveys and Mini-tasks, about all of them have a Multi-level marketing approach. They are not putting advertising everywhere, instead they have the users promoting the network, and they give rewards for doing so.

The reward is sharing with the people who invite others, part of the earning coming from the people invited by them.

It is a simple formula: you get a lot of people inside the network, and they use the network, then you get part of the earning by all of them.

But it is a little bit more than that, because the reality is that a lot of the people who gets invited won’t do much, so you need to keep inviting people until you come across the extraordinary, and it is hard to reach that point if you are not extraordinary yourself.

In the right networks you can reach financial freedom. You may become inactive at some point, get tired of doing it every day, but the people invited by you continue providing you with an income. The best in my opinion: ClixSense.

And then there is also NeoBux, an opportunity, but not for everybody.

But you are the key to unlock it.

I said it before: Not even the lottery is going to save you if you don’t change your mentality.

If you get money, the minute you get it, you will feel like buying things that you can live without. Don’t deprive yourself from absolutely everything, because you are alive and if you work you deserve to give you something. But take control of your desire to buy, that is how it will start.